Accounting Cycle Definition: Timing and How It Works

Alternatively, the budget cycle relates to future operating performance and planning for future transactions. The accounting cycle assists in producing information for external users, while the bookkeeping sacramento budget cycle is mainly used for internal management purposes. Depending on each company’s system, more or less technical automation may be utilized.

Identify Transactions

You need to identify all transactions that occur throughout the fiscal year. The best approach to do that is to create a system where every transaction is automatically captured because that prevents human error. Typically, companies integrate their accounting software with their payment processor and point-of-sale (POS) software to capture revenue. Once you’ve posted all of your adjusting entries, it’s time to create another trial balance, this time taking into account all of the adjusting entries you’ve made.

A shorter internal accounting cycle can make bookkeeping more manageable, especially when the company’s finances are complicated. However, businesses with internal accounting cycles also follow the external accounting cycle of the fiscal year. Journal entries are usually posted to the ledger as soon as business transactions occur to ensure that the company’s books are always up to date. To fully understand the accounting cycle, it’s important to have a solid understanding of the basic accounting principles.

- Without them, you wouldn’t be able to do things like plan expenses, secure loans, or sell your business.

- Typically, companies integrate their accounting software with their payment processor and point-of-sale (POS) software to capture revenue.

- If financial activity goes unidentified, it cannot be reviewed or monitored by the business.

Analyze the worksheet to identify errors.

The accounting cycle is started and completed within an accounting period, the time in which financial statements are prepared. However, the most common type of accounting period is the annual period. Once transactions are recorded in journals, they are also posted to the general ledger. A general ledger is a critical aspect of accounting as it serves as a master record of all financial transactions.

Related Posts

This new trial balance is called an adjusted trial balance, and one of its purposes is to prove that all of your ledger’s credits and debits balance after all adjustments. Understanding the accounting cycle is important for anyone in the world of business. Through accounting, financial responsibility can be taken by a company. It allows them to look at the bigger picture, and see how they’re doing business. Without accounting, the financial starting a bookkeeping business position of a business cannot be analyzed.

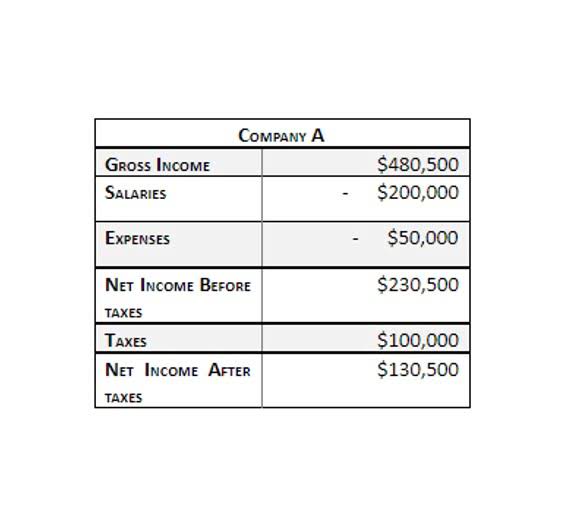

Computerized accounting systems and the uniform process of the accounting cycle have helped to reduce mathematical errors. Generally accepted accounting principles (GAAP) require public companies to use accrual accounting for their financial statements, with rare exceptions. However, you also need to capture expenses, which you can do by integrating your accounting software with your company’s bank account so that every payment will be charged automatically. Meanwhile, the remaining five steps are the bookkeeping tasks you do at the end of the fiscal year. Fortunately, nowadays, you can automate these tasks with accounting software, so doing all this isn’t as time-consuming as it might seem at first glance. First, an income statement can be prepared using information from the revenue and expense account sections of the trial balance.

If you need a bookkeeper to take care of all of this for you, check out Bench. We’ll do your bookkeeping each month, producing simple financial statements that show you the health of your business. After transactions have been identified, they have to be recorded. If a transaction is identified but it isn’t recorded, then it’s like it never happened at all.

Accrual accounting is more flexible, and it allows you to match revenue and expenses. The identification of transactions is, arguably, the most important step in the process. If transactions aren’t identified, then accounts cannot be made. This can impact a business’s financial statements and financial position.